IMPORTANT: Following my initial post yesterday, I found new and different information on parking costs for underground garages. Please see important updates at the end of this post.

Why does it cost twice as much as normal underground garages?

Over the past 7 years, I have publicly challenged many aspects of the CentrePointe project in downtown Lexington, with a particular focus on how the 700-space CentrePointe parking garage would be financed:

- I used a fable to illustrate the absurdity of funding the parking garage with tax-increment financing (TIF), and showed how the public financing scheme could be the biggest windfall for CentrePointe’s developers;

- I looked at how the shrinking size of the CentrePointe project endangered the TIF funding for the garage;

- I chronicled how the our council approved a scheme designed to defraud garage bond investors;

- Last week, I contended that the trouble that developers were having in issuing the garage bonds portended bigger problems for the CentrePointe project as a whole (regardless of whether the new mystery partner works out).

But despite all of my criticism of the financing for the garage and the viability of the entire project, I never thought to look at the cost of the CentrePointe garage itself.

I apologize.

::

A couple of weeks ago, CentrePointe developer Dudley Webb addressed the Urban County Council

to argue that the developers should not be forced to fill in the pit at CentrePointe. (His commentary begins at 26m:49s in the video. If you want to have a little fun before reading on, my response to Mr. Webb begins at 2h:12m:00s.)

In the course of his comments, Webb shared intriguing details about the finances and the challenges for CentrePointe.

In justifying the pursuit of TIF funding for the parking garage, for example, Webb casually dropped that the CentrePointe garage would cost $50,000 per space (largely driven by the requirement for underground parking). He claimed that “those numbers don’t work”.

At 700 spaces, that adds up to about $35 million for the entire parking garage.

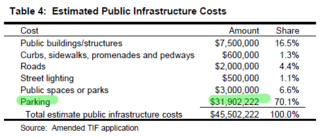

That figure seems roughly consistent with other estimates on CentrePointe: The most recent publicly-available figures [PDF link] put the parking garage at $31.9 million, which worked out to about $45,500 per space.

The $50,000-per-space figure fits with the developer’s propensity to throw out big, round numbers, but it isn’t that far from what they’ve previously claimed.

So I didn’t pay that much attention to it.

::

Yesterday, I was engaged in an online discussion about CentrePointe, and one participant asked me a number of pointed questions about how the parking garage worked.

That was when I realized that, while I knew quite a bit about the scheme to pay for the garage, I knew very little about the business model of the garage itself.

As I began to dig, I started to see that CentrePointe’s parking garage is wildly overpriced.

As I looked at parking garage studies and parking garage construction from around the country over the past 5 years, one particular figure popped up again and again for the cost of an underground garage: $20,000 per space.

From Boston to New Jersey to San Diego [PDF Link – Outdated 2002 Study], local reports put the cost-per-space of underground parking garages at about $20,000. (One went as high as $21,000 per space.) [Please see updates to these figures at the bottom of this post.]

These garages had about the same depth as CentrePointe. They had about the same capacity as CentrePointe. Nothing in the way that CentrePointe’s garage has been described makes it sound especially unusual compared to other underground parking garages around the country.

And yet, the CentrePointe garage appears to cost over twice as much as standard underground parking garages.

How can that be?

It can’t.

::

If CentrePointe used a more realistic $21,000 per space, then its 700-space garage should cost only $14.7 million.

But the CentrePointe documents show the parking garage costing $31.9 million….

Where did that extra $17.2 million come from? Welcome to the Great CentrePointe Parking Garage Mystery.

As far as I can tell, there’s never been a detailed public accounting of the costs of the garage, so I can’t tell you where these phantom ‘costs’ came from.

But I can speculate. There are a couple of likely candidates:

- The garage costs were simply inflated. A lot. And the developer hoped that no one would notice.

- The property costs (or some other non-public-infrastructure cost) were rolled into the garage costs. And the developer hoped that no one would notice.

And for over seven years, it seemed that no one noticed.

In either case, however, the result would be the same: The developer would get to pocket an extra $17.2 million funded with our tax dollars.

But why does that really matter?

Two reasons.

- First, the developer would get an unearned windfall skimmed out of public taxes. (He doesn’t need the welfare. We do need the tax dollars.)

- Second, overpaying for the garage crowds out funding for truly public infrastructure. Renovating the old Fayette County Courthouse, in particular, was supposed to be part of the CentrePointe TIF, but seems to have dropped out of the most recent TIF funding efforts. We should put it back in.

It is time to ask the developer sharper questions about the cost of his parking garage.

IMPORTANT UPDATE: The $20,000 per-space amount is not as universal as I initially found. Other studies show per-space costs for underground parking ranging from $25,000 to $35,000 per space [Both PDF Links]. (It is worth noting that the author of the latter study has made developer-friendly arguments campaigning against off-street parking requirements – i.e., parking structures like CentrePointe’s garage.)

I apologize for not finding these sources before the original post. I don’t want to mislead anyone. I do want to understand these costs better.

While these amounts would change the magnitude of the amounts I calculated above, they don’t change the core critique of the parking garage for CentrePointe.

Factoring in these new amounts, it seems that CentrePointe’s parking garage is still overpriced by between $10,000 and $20,000 per space, which amounts to extra costs of between $7 million and $14 million across the whole project.

Asking the developer sharper questions is still warranted.