In late July, one of our technicians left our award-winning auto repair shop to return to his hometown. He has been our only employee to leave since I bought the business over two years ago.

His departure raised a question for us that a lot of small businesses have faced in this economy: Do we accept the risks of hiring a new employee to replace him?

The answer, I think, is instructive for many of the economic and political issues facing our country.

::

Impatient voters punished Democrats two weeks ago for not giving enough focus to our nation’s sputtering economy after the near-implosion of 2008.

With our nation’s unemployment rate hovering just under 10% (and ‘real’ unemployment much higher), voters sent a clear signal that they want government to focus on creating jobs and growth.

According to the Small Business Administration [PDF Link], small businesses like ours make up 99.7% of employer firms, and account for two-thirds of new job creation.

Both Republicans and Democrats have reiterated the importance of getting small businesses hiring to get our country’s economy moving again.

::

This week, congress reassembles in the wake of the elections to consider extending temporary tax cuts implemented under the Bush administration in 2001 and 2003.

Republicans want to extend the entirety of the Bush tax cuts, which would add $5 trillion to the national deficit over the next ten years, and vastly expanded the national debt over the past decade.

Democrats want to extend the tax cuts as well, but would let them expire for the highest-income households which make over $250,000 per year. The Democratic plan would cost almost $700 billion less than the Republican plan over the next ten years.

Republican leaders claim that giving tax breaks to top earners is critical to generating the new jobs that the economy needs to recover.

Unfortunately, they’re wrong.

::

Just how would the Republican proposal affect small business jobs? A hypothetical example from my industry might help us get to an answer.

A very healthy auto shop might have annual sales of $1,000,000 – an amount which would put it well into the top 5% of shops nationwide. If that shop is exceptionally well-run, it might see net profits of 30%, or $300,000.

For those few shop owners in such a fortunate situation, what are the implications of extending the Bush tax cuts for those making more than $250,000? Under the Republican plan, that shop owner would save an incremental $1,500 in taxes over the Democratic tax cut plan.

As a small business owner, I’d happily take the $1,500. But such a small amount would give me zero incentive to undertake the much greater expense – and risk – of hiring a new employee.

So while extending the Bush tax cuts would certainly line my pockets, they would do little to encourage me to create jobs in my small business.

::

Some observers might contend, as incoming House Budget Committee Chairman Paul Ryan did on CNBC yesterday, that most job growth comes from larger “small” businesses and that my example above isn’t really that relevant to job creation.

So let’s pretend, for a moment, that our hypothetical business is actually 10 times as large as the example above: It has annual sales of $10,000,000, and its owners see profits of $3,000,000 per year.

Under the Republican plan, that business owner would save an additional $125,000 in taxes over the Democratic tax cut plan. Now, this seems like an amount which might let a business hire a couple of additional employees.

But while the tax savings might be enough to hire additional employees, it provides little actual incentive to use that newfound money to hire in an uncertain economic environment.

A tax windfall fails to meet a prudent business owner’s criteria for making a hiring decision. Business owners don’t hire because we have extra money laying around. We don’t hire out of charity. We hire when there is more work to do.

Again, I’d happily take the $125,000. But I’d also know that a drop of just 1% in my sales – a fairly likely risk in our current economy – would wipe out my tax savings. If I were that business owner, I’d stash my cash as a hedge against an uncertain economy. Net effect: no new jobs created.

The criteria for hiring is scalable: Whether a business has $1 million, $10 million, or $100 million in sales, the decision to hire is based on needing employees to meet demand – not on having spare cash supplied by tax cuts.

::

In my shop, the economic slowdown – coupled with a nearby street closing for almost a year – contributed to a sales decline of over fifteen percent from our record 2008 levels. The declines would have been worse if not for our solid reputation, our increased community involvement, and our vigorous marketing.

In fact, our business has more customers than ever before; It’s just that each one is investing far less in their cars. We see a lot more folks putting off needed maintenance and hoping that their cars won’t break down.

And as I look at replacing the technician who left in July, this drop in sales has been my primary consideration.

An extra $1,500 from tax cuts wouldn’t induce me to hire a new technician. Neither, frankly, would an extra $125,000.

I’ll hire when our core business is better – when there is more work to do – and not just when I have a convenient pile of cash.

And to make our business better, we need more customers with more money – and more willingness to spend.

::

To encourage small business hiring, policymakers need to encourage spending. In particular, they need to encourage the kind of spending which reverberates through the economy as that money is spent and respent in the form of wages, further buying, more wages, and – ultimately – hiring.

This respending feedback loop is key to creating enough demand that businesses like mine will start to hire again. It is key to driving our nation’s self-sustained economic growth.

The fatal flaw of tax cuts for the wealthy is that the cuts don’t foster respending at a scale which drives significant hiring. As seen in my examples above, a large chunk of each dollar given out in tax cuts to the wealthy is stowed away in savings – thereby stunting the benefits to the economy.

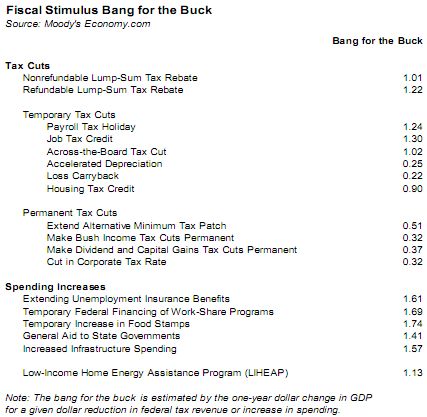

Mark Zandi, Moody’s Chief Economist, has found the same phenomenon in his research (Full PDF Here).

Tax cuts to the rich don’t yield as much overall economic benefit because the wealthy don’t need to (and won’t) spend that money, thus diminishing the virtuous feedback loop.

Government spending which goes to those in need – the poor, the unemployed, state governments – does get respent (often out of necessity) and the feedback loop is much, much stronger than with tax cuts.

::

If I’m looking at my bank account, the tax cuts seem like a fantastic idea. More money for me!

But if I’m looking at my business, my employees, their families, and my community – I want the government to focus on assisting those in need. I want the government to encourage buying (especially from small, local businesses). That’s what will help my business for the long term. That’s what will – ultimately – encourage me to hire.

Lose the tax cuts. Give me customers instead.

Unfortunately, Zandi’s multiplier effects cited have been regularly proven to be inaccurate and greatly overstate the actual multiplier effect of government spending which is less than 1.Further your assertion that the top wage earners tend to save more is correct but belies the fact that the top 3% of wage earners produce about 25% of the consumption which means they spend a lot as well. Also, federal revenues increased every year bush was in office meaning even with tax cuts, federal revenues grew. Our problem is federal spending outpaced the growth in federal revenues. In addition the “deficit” statistics you cite as part of extending the current tax rates into the future assume that the current growth in spending continues. It also does not take into account the change in perception that would come from having certainty over tax policy. For most small businesses the uncertainty over health care is a bigger driver of the unease with which hiring takes place.

I found it interesting that your example of a small business begins, baseline, with a small business in the top 5% of its class. It’s illustrative of your point on the money breakdown (it’s at the bottom end of the $250,000 cut-off and so provides a minimal baseline savings amount), but it needs to be said again: we’re only talking about the top 5% of small-businesses for auto shops. The cut-off applies to few places here. I’m not crying for either owner in the example.

On the consumption claim (top 3% consume 25%=good) by Restum. I guess I’d disagree. I find that sort of consumption horrible for the larger population. Good for economy in the short-run, good for the top 3%, but over-all not so good or desirable. What does that consumption go towards? Extra houses (which drive up property values in local markets)? Extra plane trips (which contribute to extractive industries that–whatever their use value in beneficial production–tend to be destructive of local communities and ecosystems the world over)? Extra servants or wage labor (a possibility that has not led to an increase in most American wages over the past 30 years)? Extra technology (what type and for whom?)? In fact, I’d say that, if you buy the consumptive habits of the rich as being positive, you’d also have to say that the top 3%’s inordinate interest and consumption of, say, individual goods like planes and cars, has in part at least, led to a devaluing of public interest and desire for public transportation (trains, busses, bikes).

Of course I’m not against consumption, nor the consumption by the rich, and I’m not against plane or car consumptive practices (though I think both should be shrunk severely), but I think distinctions need to be made here on what type and how much we find socially (and economically, environmentally and neighborly) desirable. 3% producing/consuming 25% is a problem, not something we should pat someone (or their rich class) on the back for–and its certainly not something that we should be helping along with tax breaks. Somewhat off topic…sorry.

Short Answer – The US needs more revenue and, for those who recall, in 1961, when our economy was seeing real, sustainable growth, the top tax rate (believe it or not) was 91%!

Today both parties agonize of a few points one way or another over 35%. Now, let’s also remember that only 1% of US citizens (+/-) make $1M+ while the mean income level of our US House is $975K and the senate is $2.5M.

Seems to me that we’re failing to recognize exactly WHO the decision makers are in this discussion, and whether or not they’re going to continue to distract us from the true issues at hand…we’re getting screwed by our own government because it serves THEM better.

Pingback: Confessions of a Job Creator | CivilMechanics

Pingback: Kentucky’s Regressive Tax Reform | CivilMechanics

Pingback: On Compromise – CivilMechanics